Single Mother Family of Five 80000 a Year

Despite some analysis from the media suggesting single parents might find being on welfare more bonny than working, more one-half of sole parents in Australia are in work and are better off as a result.

Australia's tax and social security systems are designed to collect revenue on a fair basis, to provide a means tested prophylactic net to protect people from poverty, to back up the cost of raising children and to encourage work.

The Treasurer recently said that the, "ultimate exam for whatsoever welfare system and any revenue enhancement system [is that they are] well synchronised." As the Treasurer went on to say, this means that "if you are of working historic period in this state and you are able to work that you are better off in work than you are on welfare."

At that place has been recent public argue about whether Commonwealth of australia's tax and social security systems do meet the goal of ensuring that welfare recipients have a financial incentive to seek work and, if they are working part time, to work more hours.

Does welfare for sole parents pay more than work?

We looked in detail at the instance of a sole parent with 4 kids aged 13, x, 7 and 4, proposed by Sarah Martin, "Parental Welfare Pays More than Work" in the Australian, 28 Oct 2016. Martin said that, "thousands of parents claiming government benefits are financially meliorate off not getting a job," and that x% of parenting payment recipients, or about 43,200 people, were better off than a median wage earner. Yet, this view fails to have account of benefits paid in work, designed to 'make work pay.' It as well overlooks the relative needs of such a family.

Further, as the Australian Quango of Social Service observed, four kids and a single parent is a pretty unusual family structure these days.

Sole Parent Example: Jane

Let's call our sole parent Jane, equally more than 85% of sole parents are mothers. If Jane is not in the paid workforce, she would take home $52,469 in authorities benefits for the year to heighten her family unit. Nosotros show after that this is close to the 'Henderson poverty line' for this family unit type. The Henderson poverty line benchmarks the basic income required to support different family units, and was originally ready out in the 1973 Henderson Commission of Inquiry into Poverty.

Jane does non face a unproblematic choice between welfare and work. Our system is designed to encourage piece of work, then Jane will continue to receive family benefits in work. When Jane'due south youngest kid turns six, Jane is required by police force to seek work (or written report) for at to the lowest degree xv hours a week, to get the benefits.

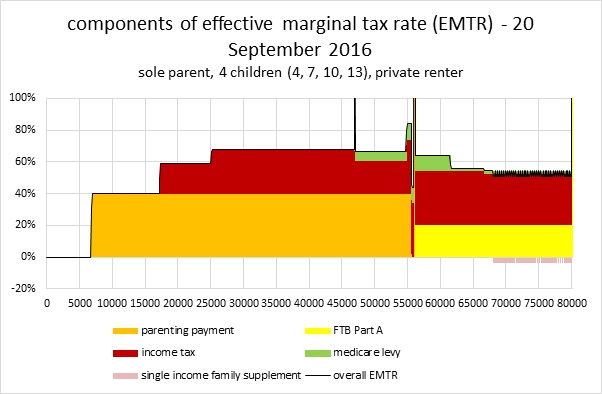

Financial incentives to work are produced by the net take-home income of a family, after tax paid and benefits received. This is reflected in the 'Effective Marginal Taxation Rate' (EMTR), which takes into business relationship tax paid and benefits lost as income from piece of work rises; and the participation tax rate, which is the boilerplate EMTR over a range of income given the decision to have up work. The EMTR for Jane for earnings up to $lxxx,000 is shown in Figure 1 below.

Figure 1 EMTR for Jane: sole parent with 4 children

Jane can earn merely over $vi,000 with no tax or loss of benefits. The EMTR on her next $ten,000 is forty% and and so to the median wage of $61,300, it is 60%-65%.

Up to the median wage, Jane's participation tax rate is almost 55%, so she is financially ameliorate off past at least $45 for each $100 earned subsequently benefits phase out and tax is paid. It's articulate that working pays for Jane, even though the EMTR looks quite high. The "spikes" where the EMTR reaches 100% employ over a minor range; hence they exercise not affect the overall picture. The coloured areas show the income tax on Jane (red), Medicare Levy (green) and withdrawal of parenting payment and Family Tax Benefit A (yellow) equally her wage income rises.

More detail about EMTRs and how they are produced by the interaction of tax and transfer systems is in Tax and Transfer Policy Plant Policy Brief 1/2016 past Ingles and Plunkett. It too includes give-and-take of possible policy responses to amend work incentives.

Jane'due south net take home pay for each extra day she works

Nosotros can show Jane's internet position after taxation and benefits, for each extra day she works, from ane day upwards to 5 days (total-time). To do this, we need to presume a wage rate for Jane.

Assuming the median wage of $61,300 (full fourth dimension, men and women), Jane'due south hourly wage charge per unit is approximately $37. The "part fourth dimension inclusive" median wage of $46,200 adopted past Sarah Martin in the Australian confuses the hourly wage rate and the hours worked. However nosotros exercise employ this lower wage later.

We as well assume, like Martin, a rental housing cost for Jane of $20,800 or $400 per calendar week, at the low stop for Sydney. Fifty-fifty at this modest rent, Jane would be in "housing stress," paying more than 30% of her income in rent.

Jane's net position if she goes to work for i twenty-four hours upwardly to 5 days is shown below (ignoring childcare and other costs). It shows a total gain from working of $27,150 a year if Jane works total-time.

Table 1 reward for working, sole parent, Median F/T wage charge per unit $37/hr, days worked 0-5

| Annual Equivalent | ||||||

| Earnings | 0 | 12260 | 24520 | 36780 | 49040 | 61300 |

| Income support | 19674 | 17499 | 12595 | 7691 | 2787 | 0 |

| Human foot | 0 | 0 | 0 | 0 | 0 | 0 |

| FTB A | 28313 | 28313 | 28313 | 28313 | 28313 | 26434 |

| FTB B | 4482 | 4482 | 4482 | 4482 | 4482 | 4482 |

| Tax | 0 | 0 | -1374 | -4741 | -8007 | -11389 |

| Medicare | 0 | 0 | 0 | 0 | -213 | -1208 |

| Dispensable income (pre-costs) | 52469 | 62554 | 68536 | 72525 | 76402 | 79619 |

| Concession Carte du jour Type | PCC | PCC | PCC | PCC | PCC | None |

| Accommodation | 20800 | 20800 | 20800 | 20800 | 20800 | 20800 |

| Disposable income afterward costs | 31669 | 41754 | 47736 | 51725 | 55602 | 58819 |

Source: D Plunkett model

Work pays for Jane even if she only works one twenty-four hour period a week. However, Jane does less well from days 3 to v of work, due to the relatively loftier EMTRs which utilize over the income range of $30,000 to $sixty,000.

The poverty line for a sole parent with four kids

The implication of the debate about being "improve off" on benefits is that welfare is also generous. But this needs to be put into perspective.

For Jane's family unit with 4 children aged 4 to 13, the standard Australian Henderson poverty line in June 2016 was $52,191 (not working) and $57,373 (working). That means the parenting benefits that Jane receives keep her family but at the poverty line. Working, as you lot might hope, actually raises Jane's family out of poverty.

Past dissimilarity, the poverty line for a single person non in piece of work was $22,211 and in work, $27,392. So even after paying income taxation, a single person on a median income would be comfortably out of poverty.

Costs of Childcare

Both the Treasurer and the Australian commodity noted in a higher place are silent on the issue of childcare. This is strange considering, unless Jane has a relative who can provide care for free, childcare for her iv year old and afterwards-schoolhouse intendance for her seven year old and 10 twelvemonth old are crucial for her to work.

Childcare is supported by a childcare rebate and childcare do good, which are currently proposed to be consolidated into one payment in the Government's childcare reform package introducing Child Care Subsidy from the Budget. This new package is important, just Ministers Christian Porter MP and Simon Birmingham MP insist they will not "add" childcare to "the nation'south credit card," but must fund it by trading off with other social security cuts. This trade-off includes family benefits, as explained here, which will make many families worse off.

Modelling childcare is complex considering of the various hours, packages and fees for care. Nosotros have done a simple model of Jane'south situation with childcare added (under the current regime). We've assumed Jane'south eye two children are in after-school treat 3 hours for each day she works, and the youngest is in long mean solar day intendance (LDC), charged for ten hours for each 24-hour interval worked (session basis). We used $10 per hour for LDC and $vi per hr per kid for after-schoolhouse intendance. Finally, we assume she had no childcare for the eldest kid.

Tabular array 2: Reward for working after childcare costs, sole parent Median F/T wage rate $37/hour, days worked 0-5

| Annual Equivalent | $ | $ | $ | $ | $ | $ |

| Earnings | 0 | 12260 | 24520 | 36780 | 49040 | 61300 |

| Parenting Payment (Income back up) | 19674 | 17499 | 12595 | 7691 | 2787 | 0 |

| Family Tax Do good A | 28313 | 28313 | 28313 | 28313 | 28313 | 26434 |

| Family Tax Benefit B | 4482 | 4482 | 4482 | 4482 | 4482 | 4482 |

| Income Revenue enhancement | 0 | 0 | -1374 | -4741 | -8007 | -11389 |

| Medicare Levy | 0 | 0 | 0 | 0 | -213 | -1208 |

| Child Intendance Do good | 0 | 3858 | 7716 | 11576 | 14475 | 16822 |

| Child Care Rebate | 0 | 1607 | 3214 | 4820 | 6906 | 9269 |

| Disposable income (pre-costs) | 52469 | 68020 | 79466 | 88921 | 97784 | 105710 |

| Concession Card Type | PCC | PCC | PCC | PCC | PCC | None |

| Accommodation | 20800 | 20800 | 20800 | 20800 | 20800 | 20800 |

| Child Care | 0 | 7072 | 14144 | 21216 | 28288 | 35360 |

| Disposable income later costs | 31669 | 40148 | 44522 | 46905 | 48696 | 49550 |

Source: D Plunkett model

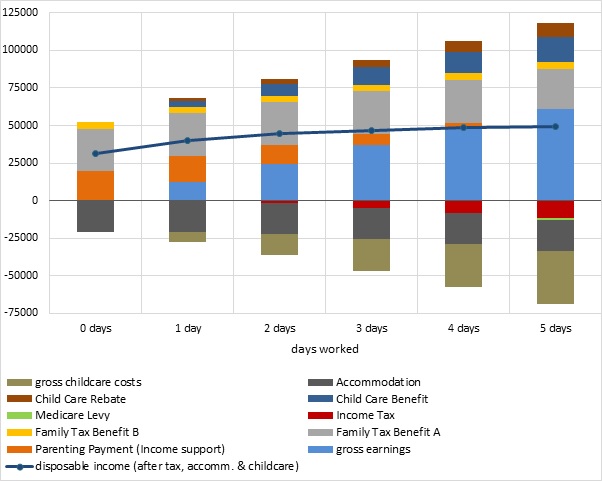

These tables can be represented graphically. The upper portion of the bars in Figure 2 represent the components of gross income; the lower portion the components of gross costs (hire, childcare and tax). The resultant is the disposable income line shown in blue. Information technology can be seen that this is relatively flattened, particularly after days 1 and 2.

Figure ii Reward for working after childcare costs, sole parent Median F/T wage rate $37/60 minutes, days worked 0-five

Source D Plunkett model

Reward for working – boilerplate sole parent hourly rate

Median total-time income used in the previous graphs includes both males and females. Females, especially sole parents, may realistically have lower incomes than this. So we at present utilise an hourly charge per unit ($xxx) derived from median total and part time earnings of $46,500 pa. These figures are consequent with those used in the Australian article cited. They are likewise consistent with the average wage for a sole parent equally calculated past the ABS. For single parents who are employed their hateful hourly rate is $29.xxx and median is $26.25 per hour. These figures are based on the ABS Survey of Income and Housing updated to 2016.

Table 3: Reward for working afterward childcare costs, sole parent wage rate $xxx/hr, days worked 0-v

| Almanac Equivalent | $ | $ | $ | $ | $ | $ |

| Earnings | 0 | 9300 | 18600 | 27900 | 37200 | 46500 |

| Parenting Payment (Income support) | 19674 | 18683 | 14963 | 11243 | 7523 | 3803 |

| Family unit Revenue enhancement Benefit A | 28313 | 28313 | 28313 | 28313 | 28313 | 28313 |

| Family Tax Do good B | 4482 | 4482 | 4482 | 4482 | 4482 | 4482 |

| Income Tax | 0 | 0 | -255 | -2264 | -4858 | -7453 |

| Medicare Levy | 0 | 0 | 0 | 0 | 0 | 0 |

| Child Care Benefit | 0 | 3858 | 7716 | 10353 | 13253 | 14475 |

| Child Intendance Rebate | 0 | 1607 | 3214 | 4496 | 6581 | 6906 |

| Disposable income (pre-costs) | 52469 | 66244 | 77033 | 84523 | 92495 | 97027 |

| Concession Carte Type | PCC | PCC | PCC | PCC | PCC | PCC |

| Adaptation | 20800 | 20800 | 20800 | 20800 | 20800 | 20800 |

| Child Intendance | 0 | 7072 | 14144 | 19344 | 26416 | 28288 |

| Disposable income after costs | 31669 | 38372 | 42089 | 44379 | 45279 | 47939 |

Source: D Plunkett model

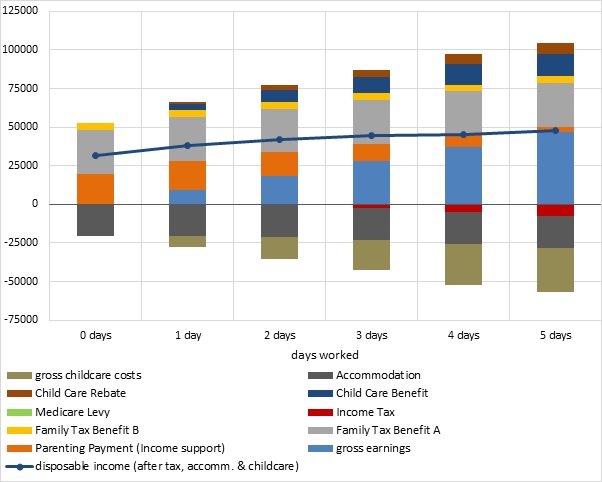

Again, nosotros tin bear witness this tabular array equally a figure (Figure 3). The flattening of the dispensable income line is, as before, quite marked.

Figure 3 Reward for working later on childcare costs, sole parent wage rate $30/hour, days worked 0-5

Source: D Plunkett model

The in a higher place example assumes formal (paid) childcare. Many families do rely on informal (due east.g. family unit) childcare to fill gaps at the start and cease of days and for whole days. Even if paid for, childcare is very variable in type and cost. These cameos use the 'policy consistent' arroyo which takes the current circumstances and simply extrapolates over a year. The children and adults don't historic period and there's no adjustment for upcoming CPI increases or other changes, including school holidays which interrupt work patterns and opportunities.

Then this modelling provides a generalised expect at the combined impact of the various childcare schemes, not a definitive calculation of an private'due south results.

Working pays, merely childcare, flexibility, and other costs are as well critical

We conclude, as shown in the Tables above, that there is a financial reward from working in all cases. However, it is more than attenuated later taking into business relationship childcare costs and (ofttimes) lower female wages. In particular, working full-time is less bonny at a depression wage, given the trade-offs with parenting time for a sole parent. This is consequent with the conclusions of the Productivity Commission 2015. It means that sole parents, unless they can go well paid, full-time work, often miss out on the other benefits of total-time work including superannuation contributions, paid leave, preparation, development and career progression.

Even with childcare and assuming there is a suitable chore bachelor, for a unmarried parent with four kids, parenting is pretty enervating. What if they get sick? How far is work and school from home? How can later-school sport exist managed? The financial costs of working such as commuting and clothes will as well be challenging for Jane. In that location will be many situations where the financial incentives are not sufficient. Jane needs to weigh upward all the costs and benefits when making a work conclusion.

Charts and graphs by David Plunkett.

Originally published by the Chat.

Source: https://www.austaxpolicy.com/pay-work-case-single-parent-4-children/

0 Response to "Single Mother Family of Five 80000 a Year"

Postar um comentário